How to Use the Billing Tax Portal

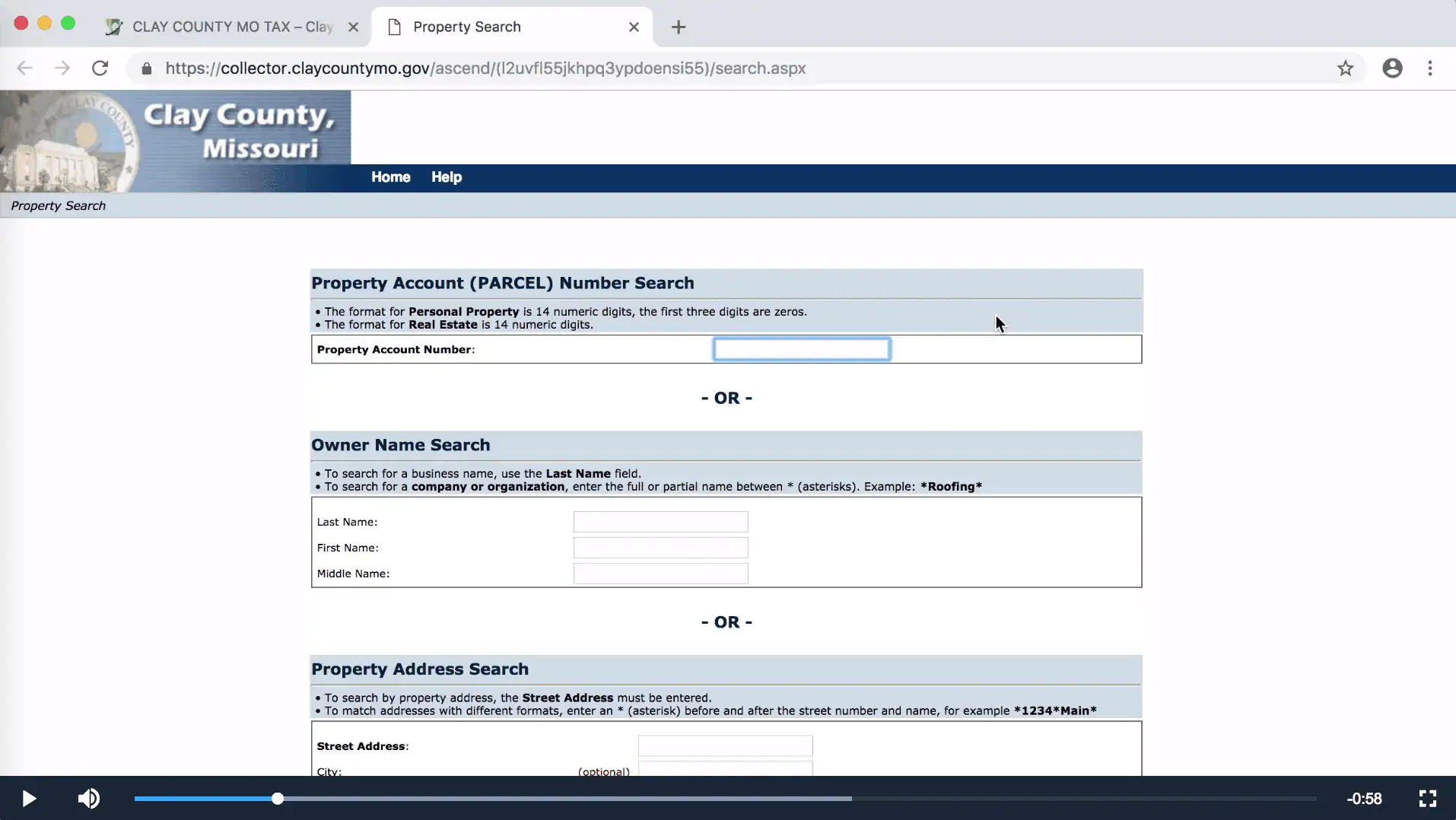

How to Access the Billing Portal:

- Click here to open our billing portal in a new window

(or click the PAY BILL / RECEIPTS button above). - Type your full last name.

- Type only the first several letters of your first name (no middle initial).

- Click the green Submit button.

What Can I Do With the Billing Portal?

Once you click on the blue parcel number link, you will be taken to the tax bill for that parcel. On this page, you can:

- view the address associated with your account

- view the property we assessed and the value assigned to it

- view the levies that apply to your bill

- view your current amount due and pay your bill

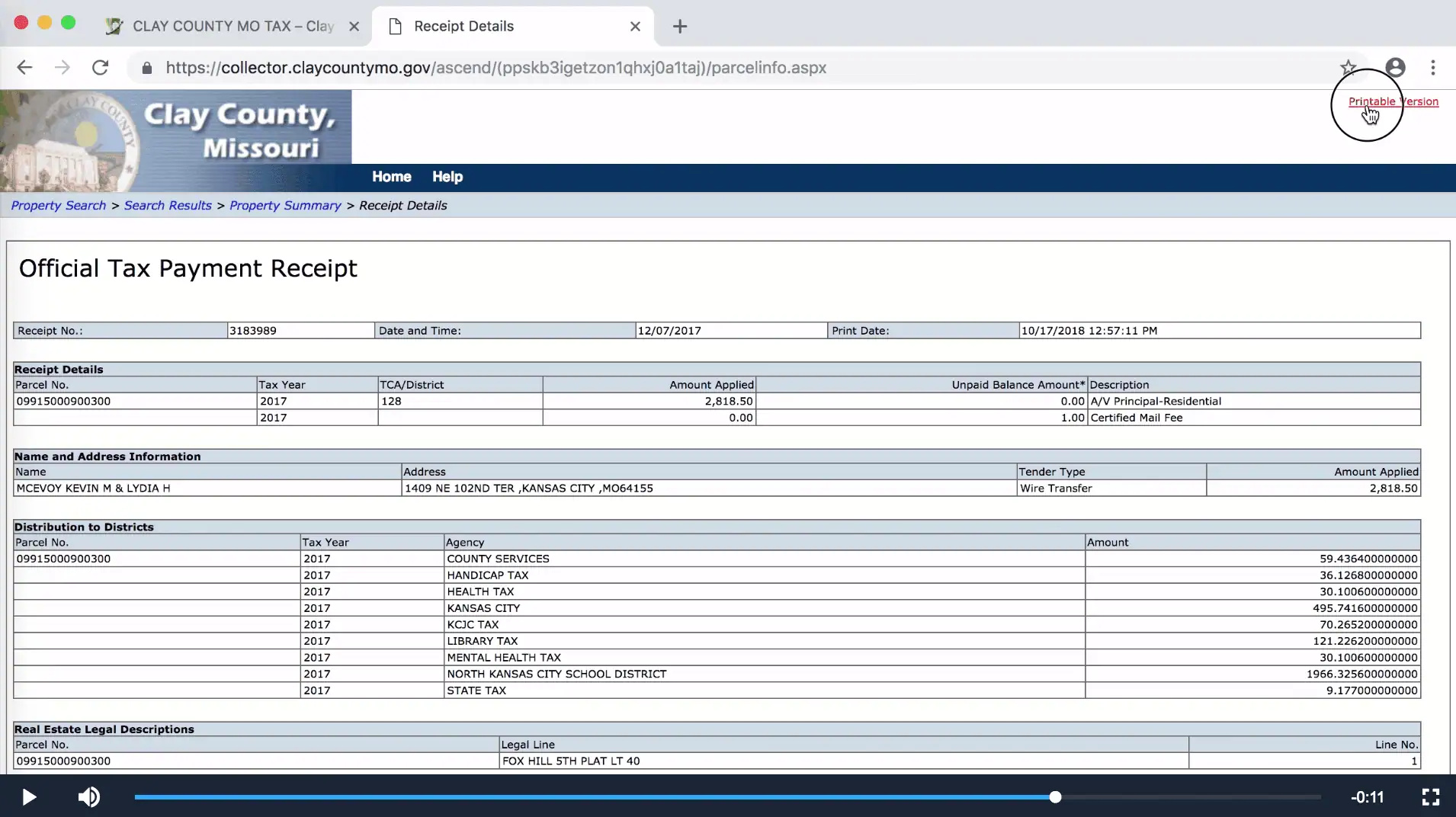

- view and print past paid receipts

Payment Fees

These are credit card processing fees and apply to both online and in-office payments.

| Debit Cards | FREE |

| Credit Cards (we accept VISA, MasterCard, Discover, and American Express) | 2.45%, no minimum |

| E-Check (use the routing and account number from the bottom of your check) | FREE |

How to Pay Your Tax Bill

How to Print Tax Receipts